Rising Consumer Expectations

Consumer expectations regarding in-flight services are evolving, significantly impacting the In Flight Internet Company Market. Passengers now anticipate high-speed internet access as a standard offering rather than a luxury. This shift in consumer behavior is driven by the increasing reliance on digital devices for work, entertainment, and communication during flights. Data indicates that over 70% of travelers consider in-flight Wi-Fi an essential service, which compels airlines to enhance their internet offerings. As a result, airlines are investing in better infrastructure and partnerships with technology providers to meet these rising expectations. The ability to provide reliable and fast internet access can lead to higher customer satisfaction and loyalty, ultimately influencing the airline's profitability and market share.

Regulatory Support and Compliance

Regulatory frameworks play a crucial role in shaping the In Flight Internet Company Market. Governments and aviation authorities are increasingly recognizing the importance of in-flight connectivity and are implementing regulations that support its growth. For instance, some regions have relaxed restrictions on the use of electronic devices during flights, which has a direct positive impact on the demand for in-flight internet services. Additionally, compliance with safety and security regulations is essential for service providers, as it ensures the protection of passenger data and enhances trust in these services. As regulatory support continues to evolve, it is likely to create new opportunities for growth within the market, enabling airlines to expand their offerings and improve service delivery.

Competitive Landscape and Market Dynamics

The competitive landscape within the In Flight Internet Company Market is intensifying as more players enter the market. Established airlines are not only competing with each other but also with new entrants that offer innovative solutions for in-flight connectivity. This competition is driving down prices and improving service quality, as companies strive to differentiate themselves. Recent market analysis suggests that the number of airlines offering in-flight internet services has increased by over 30% in the past two years. This influx of competition is beneficial for consumers, as it leads to more choices and better pricing. However, it also poses challenges for companies that must continuously innovate to maintain their market position and meet evolving consumer demands.

Technological Advancements in Connectivity

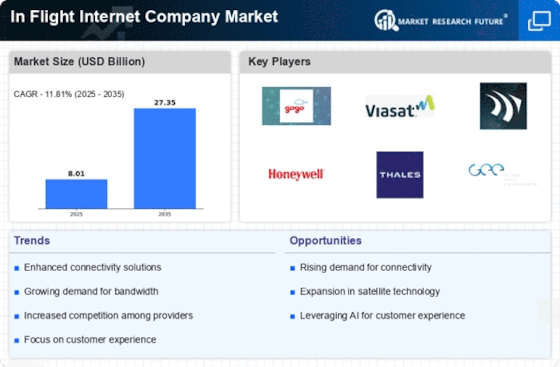

The In Flight Internet Company Market is experiencing a surge in technological advancements that enhance connectivity options for passengers. Innovations such as satellite-based internet systems and 5G technology are becoming increasingly prevalent. These advancements allow airlines to offer faster and more reliable internet services, which is crucial for meeting the expectations of tech-savvy travelers. According to recent data, the market for in-flight connectivity is projected to grow at a compound annual growth rate of approximately 12% over the next five years. This growth is driven by the need for seamless connectivity during flights, as passengers increasingly rely on internet access for work and leisure. Airlines that invest in these technologies are likely to gain a competitive edge, as they can provide superior service and attract more customers.

Emerging Markets and Expansion Opportunities

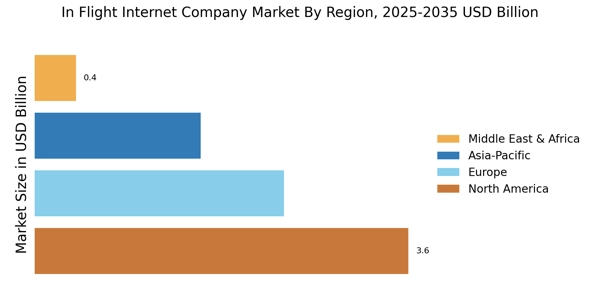

Emerging markets present significant expansion opportunities for the In Flight Internet Company Market. As air travel becomes more accessible in developing regions, the demand for in-flight connectivity is expected to rise. Data suggests that regions such as Asia-Pacific and Latin America are witnessing rapid growth in air travel, with passenger numbers projected to increase by over 50% in the next decade. This trend is prompting airlines in these regions to invest in-flight internet services to cater to the growing number of travelers. Furthermore, partnerships with local telecommunications companies can facilitate the deployment of advanced connectivity solutions, allowing airlines to tap into these emerging markets effectively. The potential for growth in these regions is substantial, as more passengers seek reliable internet access during their flights.